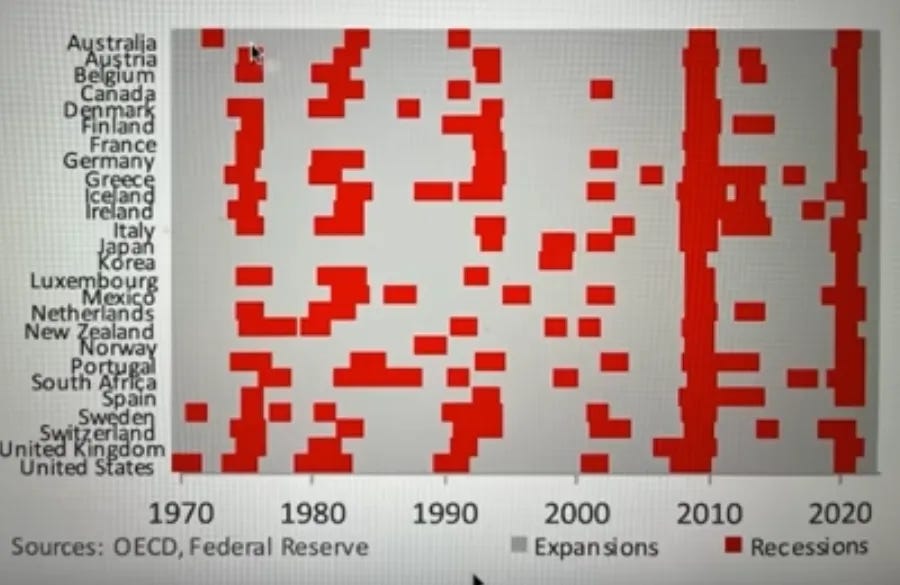

Ten days ago, George Gammon over at Rebel Capitalist presented some fascinating data on the growing tendency towards planet-wide recessions over the past 50 years, using data gathered by Mike Maloney.

The chart above marks a red square for 26 major economies if there was a recession in the year shown. We can see the US and the majority of global economies went into recession in 1974, 1981, 1991, and 2001. In 2009, every country shown went into recession. In 2020, only Sweden - which didn’t do the COVID lockdowns - escaped the global recession.

One could argue perhaps that the US pulls the rest of the the world into recession when its economy slows down, but the US went into recession in 1970 without creating a global slowdown. It seems far more likely that any spreading slowdown in global trade will gradually pull most of the countries in the world into economic contraction, regardless of where that slowdown begins.

Why do I think this is important? Donald Trump is threatening all and sundry with tariffs these days. Though he has backed off, temporarily, from 25% tariffs on Mexico and Canada, the threat of tariffs still hangs over both countries. He has hit China with new tariffs, and is threatening the European Union with heavy new tariffs.

If all the countries Trump is threatening with tariffs had robust economies, it would be less of an issue. But they’re not.

The currencies of Canada and Mexico are in free-fall. When Canada’s 2024 per-capita GDP figures come out at the end of this month, it is likely Canada will have seen no growth at all in per-capita GDP over the past decade. Germany’s economy has been shrinking for the past two years; France and Britain are not doing much better. Japan stumbles from one recession to the next. Even China is having trouble with its real estate sector and its banks.

When so many of the world’s important economies are already showing signs of fragility, trade wars and even the threat of trade wars could easily push one or other into a full-blown recession. From there, the contagion can be expected to spread, like a series of dominoes toppling over.

If the US economy were in great shape, America might be able to cope with all of its major trading partners buying fewer US goods as a result of a global slowdown.

But the US economy is not in great shape. US consumers are maxed out on their credit cards; their savings, almost non-existent. The Commercial real estate sector is a ticking time bomb. US stocks are arguably overpriced relative to their earnings. US Banks still hold a ton of long US Treasuries that are now worth way less than what the banks paid for them.

For the past four years, the US economy has appeared to be relatively robust, but only because every year the US Government has been spending a couple of trillion dollars it doesn’t have. Take that away and any semblance of a healthy economy disappears. Continue with those runaway deficits and US bond holders will demand higher and higher interest rates. High bond interest rates mean all forms of interest - on credit card debt, on new mortgage debt, on US Government debt - all become more onerous, and a bigger and bigger drag on the economy.

Please note: there’s no easy answer here. If the US brings it’s massive deficits under control, it will cause one set of bad outcomes for the US economy. If it doesn’t bring those deficits under control, it faces a different set of bad outcomes.

All of this is to say, I think Donald Trump should be really careful not to take a wrecking ball to too many of his major trading partners. Canada and Mexico both buy hundreds of billions of dollars of US products. Ditto for China and the European Union. Trump can grouse all he likes about trade deficits, but the fact remains that many hundreds of thousands of American jobs depend upon US exports to those four jurisdictions.

If most of the world falls into recession this year or next, I suspect America’s own chances of escaping recession are somewhere between minimal and nil. The US has too many of its own economic struggles for it to be otherwise.

There’s a second issue here. Trump has had some undeniable success in bullying Canada, Mexico, Colombia and Panama. Today he is placing South Africa under economic sanctions. His latest gambit with Ukraine is to say he’ll continue providing US weapons if Ukraine signs over title to its rare earth mineral resources. (Which reminds me of a mafia Don offering ‘protection,’ for a price.)

The problem is that the rest of the world sees all this. I am sure the ambassadors of Russia, China and Iran are bending diplomatic ears wherever they can, saying that America has always been a bully; that Trump just makes it more obvious. That joining BRICS+ is the only way to protect your country from American bullying.

The BRICS+ nations already include half the world’s population. BRICS+ includes the industrial powerhouse of China, the agricultural powerhouse of Brazil, and the resource powerhouse of Russia. Countries that join BRICS instantly have a broad array of trading partners, and little or no need to trade in dollars.

The more countries de-dollarize, the more structures for non-dollar trade get put in place, and the easier it gets for still more countries to de-dollarize. (A different form of dominoes, if you will.)

It is not surprising that Donald Trump has been so vociferous in threatening countries that de-dollarize with 100% tariffs. De-dollarization presents a very real danger to the United States.

The nations of the world have borrowed many trillions of dollars from the US Government in the form of US dollar currency reserves. But once a nation does most of its trading in currencies other than the US dollar, there’s no need to keep those US dollar reserves. (In fact, it’s probably safer to ditch those reserves, so the US can’t steal them, the way they stole Russia’s reserves!)

China has already been selling hundreds of millions of dollars in US bonds. So has Japan. Add in a few dozen other countries actively de-dollarizing, and who the hell is going to buy all that US debt? Higher and higher interest rates will be required to induce buyers to buy US bonds that are falling in value. When you owe 36 trillion dollars, and no-one wants to hold that debt, that is a VERY BIG PROBLEM.

In summary, I would humbly suggest to Mr. Trump that causing serious damage to your major trading partners could easily come back to haunt you, big time. And that attempting to bully and threaten nations which de-dollarize may, in fact, cause the world to de-dollarize even faster.

I’m not saying America should never use a big stick to get what it wants, just to use that stick sparingly, or you may end up creating more and bigger problems for yourself...

P.S.: Please allow me one last rant.

Mr. Trump is being extremely disingenuous to blame other nations for the deindustrialization of America. (To put it as politely as I can.)

The US Congress and the US Senate were bought out by the uber-rich and mega-corporations fifty years ago. At their behest, the US Government put in place free trade agreements without rules or guard-rails.

Factories predictably moved to countries where workers were super-exploited. Walmart could have a product made in China at a third of the cost of having it made in the US, sell it at two-thirds of the US cost and still make a handsome profit; hence the Walmart billionaires.

It also enable big business to make US labour unions impotent, so that higher productivity no longer resulted in higher wages. (Keep your wage demands modest, or the factory is moving to Burma!)

The deindustrialization of America was made in America. Mr. Trump is quite correct to want to reverse that, but he should at least acknowledge that the wound was self-inflicted.